(Exclusive) Natural and Organic Leader Departs Kroger; Chilly is Hot for Daily Harvest, Omsom Deal Numbers

Plus, new products from IDDBA!

Oh man, to all my new subscribers thank you! Apparently there are A LOT of you who also like to nerd out about groceries. If you know other CPG fans, please don’t forget to forward them this newsletter and peer pressure them into subscribing.

To kick things off, a little shameless self-promotion. This week I spoke with ModernRetail about why cottage cheese continues to draw consumer interest. It’s a breakfast staple for me, so I hope this category continues to grow. I am also publicly declaring my request for Good Culture to bring back its Kalamata Olive flavor. RIP.

And now, let’s get to what you came here for.

Holly Adrien is On the Move

There’s big news coming out of The Kroger Company, and it’s not merger-related. Holly Adrien, the retailer’s Natural and Organics Strategy and Innovation Manager, has departed the Cincinnati-based grocer. Yesterday was her last day at the company.

“I've been honored and fortunate to be part of a great organization with over 18 years at dunnhumby USA, 84.51° and The Kroger Company,” Adrien told me. “I’ve loved working with so many emerging brands as really a retail strategist. I just found a real joy in bringing all the different pieces and components together.”

Adrien has been crucial in keeping the retailer on trend, helping it remain a category leader amidst fierce competition. Her efforts included creating a classification for Kroger stores with higher than average levels of natural and organic shoppers.

“By identifying our top stores for natural organic [shoppers], that helped us internally and externally understand where we could place bets on brands and give them opportunities first.”

In addition to working with Kroger’s category managers and buyers, she also provided advice to thousands of emerging brands.

“Holly’s passion for ensuring shoppers have access to healthy, up-and-coming brands is unmatched, Annie Streit, Chief Commercial Officer at Daily Harvest, told me. “She’s incredibly knowledgeable about current food trends and is a true nurturer and generous supporter of the talent around her. Working with Holly on Daily Harvest’s launch at Kroger was an absolute pleasure.”

A Brief Interlude: At trade shows, I tried to spend every minute walking the show floor. The ONLY person who usually beat me was Holly. She’d even leave Expo East and West on a Sunday so she didn’t miss a moment of Saturday.

Adrien was also passionate about working with the Kroger Health team and integrating food into the retailer’s wellness business.

“Using food as medicine is about proactively encouraging healthy living versus just reacting and treating a problem,” she told me, adding that she feels there’s still robust opportunity for food brands to help solve pressing health needs.

While Adrien is still determining her long-term plans, they will involve “continuing to add value for brands and being a valuable part of the food and beverage industry.” So stay tuned for her next moves. In the meantime, you can connect with her on LinkedIn for strategy and consulting needs (or ask about the time she challenged a UFC fighter to a brawl).

In the meantime, I asked her to share one tip for brands working with retailers in the current economic climate.

“There’s a real opportunity to do a bit more homework and understand where the other side is coming from,” she said. “Every side of the business is challenged to grow right now. The strongest brands are doing more to understand individual retailers and find unique opportunities with each rather than using a one-size-fits-all strategy.”

Can Daily Harvest Play Double Duty as a Supply Chain Partner?

You probably have noticed that frozen food brand Daily Harvest has been on a major expansion kick, adding new retail partners such as Target and Costco and new products like pops. It’s impressive growth for a brand that has only been in retail for roughly a year, but according to CEO Ricky Silver, the growth speaks to just how powerful the brand’s concept and product mix are.

“Our awareness is at a high enough percentage, [while] our categories extend across day parts [and that combined] affords us an opportunity to introduce the brand across multiple areas of the retail landscape all at once,” CEO Ricky Silver told me. “A lot of emerging brands struggle with how to logistically support all of those priorities at once but because of the supply chain we’ve built…and the operational excellence that we've focused on, we're actually in a very strong position to run these, call it ‘experiments,’ in parallel.”

It’s that “operational and supply chain excellence” that I wanted to better understand. And it turns out that while it’s clear that brick-and-mortar retail remains a top priority, there’s also an opportunity for revenue growth behind the scenes. Daily Harvest will always be a food company first and foremost, Silver told me, but it can also be more than just a physical brand.

For example, later this month, the company is bringing online a whole new type of manufacturing: dry ice. If you’ve ever worked with a perishable product, you know how expensive and complicated dry ice can be. (Honestly, as a former frozen food marketer, I got way too excited at this point in my interview with Silver.) For now, the line will serve Daily Harvest’s East Coast operations, but future geographic expansion may be in the cards and eventually offered to other food companies.

“We are exploring ways to leverage our [operational and supply chain know-how] beyond our own business,” Silver said. “A philosophical point of view…that I've had for a long time is that the greatest businesses are the ones that collaborate.”

Solving pain points like this could also help the company add a new revenue stream: acting as a supply chain partner. For emerging brands, Silver said, Daily Harvest could eventually take over some of the painful parts of fulfillment and logistics, such as assisting with delivery to end customers. This would not only add to Daily Harvest’s bottom line, but also help the company fully utilize the scale it’s built.

“There are many smaller brands in the perishable space in particular, that are looking to solve similar problems we are. Values aligned brands that are looking to make it easier to make better choices,” Silver said. “And if we have an asset that helps them bring that to life, why not leverage it?”

Investors get the bigger picture, Silver said, with the company bringing in an additional $11.5 million round of funding earlier this spring. While that cash is largely earmarked for the food business, investors are aware that there are other opportunities on the table.

“We're lucky to have investors that are very enthused about the future and we wanted to have the healthiest balance sheet as possible as we work to expand into these new distribution channels,” Silver said.

Omsom Deal Numbers

You’ve probably already heard that indie darling Omsom was acquired by Asian-food rollup DayDayCook this week. According to a press release, Omsom’s Q1 revenue was up 324% year-over-year at the time of the sale, with its sauce and noodle kits sold in over 2,000 stores nationwide. Often, a press release is where the acquisition details might end, but because DayDayCook is a publicly traded company, with a little research you can find out a whole lot more about this deal. Let’s break it down:

Omsom was acquired by DDC Omsom, a wholly owned subsidiary of DayDayCook, on June 6. The deal included substantially all the assets of Omsom, including cash, receivables, and inventory.

In 2023, DayDayCook reported to investors, Omsom had gross revenues of $3.7 million.

As part of the transaction, DayDayCook agreed to assume certain obligations, including bank debt of approximately $800,000, and promised to provide $3 million in working capital over the three-year period following the closing of the acquisition. One remaining question I have is whether there were other obligations or liabilities on Omsom’s balance sheet that DayDayCook did not assume responsibility for.

“Subject to achievement of net revenue and net profit goals,” DayDayCook will also pay an “additional purchase price consideration to Omsom” of up to $11.7 million, with 50% of the value in cash and the remaining 50% in company stock. What this amount is “additional” to remains unclear. Note that the capital and stock are being paid to “the company,” so it's unclear who exactly will be taking those shares or getting paid out. Prior investors?

In conjunction with the Omsom announcement, DayDayCook also informed stockholders that it had terminated a previous agreement to acquire 51% of G.L. Industry, S.p.A, an Italian producer of Asian ready-meals.

Roughly a year ago, DayDayCook acquired 100% of Cook San Francisco, which operated the Nona Lim brand, for approximately $1.98 million in cash and shares of DayDayCook valued at around $1.3 million.

News Bites:

Guess Who? This week two snack brands hinted at future partnerships with notable celebs. First, functional food brand Amia teased the upcoming announcement of a new celebrity Co-Founder & Chief Brand Officer. Meanwhile, IQBAR founder Will Nitze also posted that the brand signed a deal with “the most decorated chef in America.” Who are we betting on — Thomas Keller? Interestingly, a day later Nitze shared a second post about his marketing strategy. “There are only so many celebrities, celebrity brands often flame out, and celebrity-brand fit is hard to predictably achieve,” he wrote. “Thus, you're almost certainly better off thinking deeply about how your brand can forge a path to cult status.”

Lesser Evil Says So Long to Cassava: After a Consumer Report's investigation found high levels of lead in its Lil’ Puffs, snack brand Lesser Evil announced today that it will phase out its use of cassava flour, the ingredient that reportedly caused these issues. The brand maintains that it “regularly test[s] its products to ensure that they are safe and even since the recent news story broke, again tested all of [its] products and have confirmed that everything meets safety standards, including lead levels.”

Moving on Up: After serving as Danone’s Chief Strategy and Transformation officer for the past three years, Wendy Nunnelley has been promoted to President and GM of Danone’s Plant-Based Business Unit. I am assuming this means she’ll oversee brands including Silk, and not that her team is made up of tofu and pea protein. Nunnelley previously held executive roles at Diageo and The Coca-Cola Company.

Funday News: Collaborative Fund announced the close of its Fund IV, coming in at $125 million. Founder and Managing Partner Craig Shapiro wrote on LinkedIn that the fund will continue to deploy capital in early stage companies operating at “the intersection of for-profit and for-good.” Within CPG, Collaborative Fund’s current and prior investments include Immi, Magic Spoon, Good Meat, Impossible Foods and Zack’s Mighty.

Feeling Cheesy: Do you dig dairy and sell cheese (shredded, chunks, slices, snack cheese or spreads)? Give me a call. No, just kidding. While my dairy love knows no bounds, you should, however, shoot Nate Cormack over at Lunds & Byerlys a note. Cormack shared on LinkedIn that the retailer is reviewing its dairy cheese category and looking for new brands/products.

Getting Saucy: The band is getting back together with the news that Jim Morano has joined premium Italian food brand Carbone Fine Foods as its Chief Sales Officer. Morano knows a thing or two about sauce, as well as about his new boss, CPG guru Eric Skae. The duo held C-Suite roles at Italian food brand Rao’s, with Morano serving as President from August 2016 through December 2019 and Skae as CEO from August 2016 through May 2018.

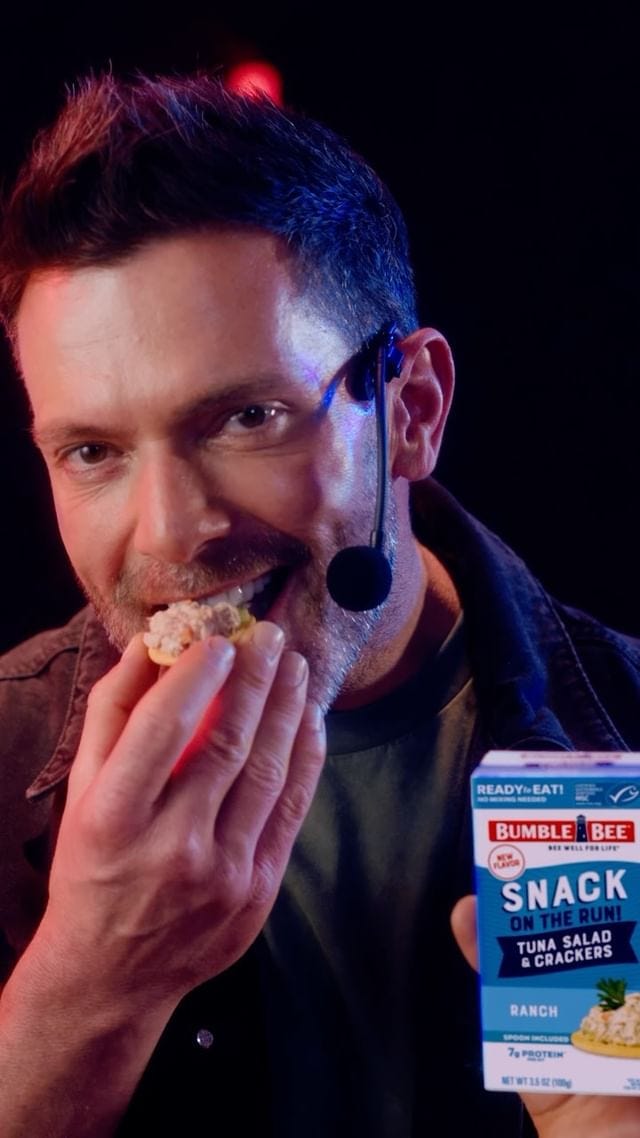

Tuna Jams: IYMI….Guys, a tuna fish BBMAK (IYKYK) collab was not on my summer bingo card. So, will there be a tuna snack stand on the band’s upcoming tour?

Add to Cart: Products To Look Out For

Several brands revealed new products at this past week’s IDBBA trade show including:

Mediterranean food brand Fun Sesames made its debut under its new brand moniker, Tal’s. In addition to its signature Tahini Dip, the brand’s portfolio now includes Original Toum, Cilantro Jalapeño Toum and Baba Ganoush. If you haven’t tried Tal’s flagship tahini sauce, do yourself a favor and pick up a tub. Signed, a tahini addict.

Dip Darling Ithaca Hummus previewed a new Black Bean Hummus.

Wonder Monday, a producer of low-sugar, high protein desserts, sampled their new cheesecake bites and an updated recipe for their mini cheesecakes. FWIW, I don’t have a sweet tooth and tend to dislike the taste of alt-sugars, but I thought the previous formulation was pretty great. And, if you need an a icebreaker at your first meeting, ask the two Wonder Monday founders how they met.

My/Mochi is continuing to expand into baked goods. After seeing traction with its waffle bites, the company highlighted its new Mochi Donut at the show.

Cured meats brand La Quercia is bringing back its Spreadable Salami, which is made with spicy nduja. Now sold in a rolled tube format, the product can be merchandised alongside other cured sausage products.

Is there anything Dolly Parton can’t do? The country superstar has partnered with Acolade Wines to launch Dolly Wines. First up, a chardonnay packaged in a Dolly-esque bottle that features glittery butterflies.

Want to Work in CPG?

I scream, you scream we all scream for…working at Ben and Jerry’s as a Digital Marketing Manager. Hm, doesn’t roll off the tongue the same way. One benefit of the gig (besides oh working for Ben and Jerry’s): three free pints of ice cream a day!

Snack brand Skinny Dipped is looking for a Director of Creative Strategy and Community to find “new and interesting ways to bring SkinnyDipped to life.” One thing that stood out to me was a possible nod towards the company’s marketing strategy, with the job post stating candidates will ideally have “6-8 years of marketing experience at disruptive beauty/lifestyle/fashion brand” … not food and beverage. Just more evidence that brands are no longer thinking about themselves as just products, but also platforms.